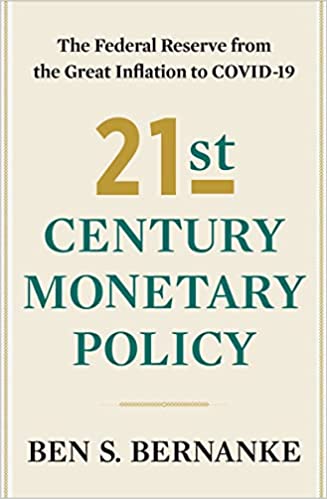

21st Century Monetary Policy : The Federal Reserve From The Great Inflation to COVID-19

Delivery Charge (Based on Location & Book Weight)

Inside Dhaka City: Starts from Tk. 70 (Based on book weight)

Outside Dhaka (Anywhere in Bangladesh): Starts from Tk. 150 (Weight-wise calculation applies)

International Delivery: Charges vary by country and book weight — will be informed after order confirmation.

3 Days Happy ReturnChange of mind is not applicable

Multiple Payment Methods

Credit/Debit Card, bKash, Rocket, Nagad, and Cash on Delivery also available.

|

Title |

21st Century Monetary Policy : The Federal Reserve From The Great Inflation to COVID-19 |

|

Author |

Ben S. Bernanke |

|

Publisher |

Norton |

|

Number of Pages |

480 |

|

Language |

English (US) |

|

Category |

|

|

First Published |

MAY 2022 |